Nous apportons des investissements

avec engagement,

but et alignement

Les marchés financiers privés sont devenus un lieu complexe et risqué où transiter sans orientation. Il existe de nombreux objectifs différents liés aux différentes formes de capital privé et, ce qui est parfois encore plus risqué, aux implications qui y sont liées.

Chez FdN, nous passons des heures de R&D à réseauter, à rechercher et à profiler toutes les formes de capital privée et de dette pour les différentes situations d'entreprise, échéances, alignement des objectifs, gouvernance, antécédents, culture, etc. de chaque alternative.

Nous investissons et co-investissons également directement nous-mêmes dans certaines opportunités.

Dans toutes les situations, nous veillerons à ce que les investisseurs soient à l'aise et alignés sur les besoins des Actifs et les objectifs de la Propriété. Pour l'Actif, FdN est le "phare" nécessaire pour naviger dans les eaux du capital privé. Pour les Investisseurs, est la source d'opportunités qualifiée et, dans certains cas, un bon partenaire spécifique à une mission particulière.

HOW WE HELP

Our Vertical Approach is guiding us naturally to facilitate and support Corporate Initiatives in Multinational Companies and International Groups to help them achieve Strategic Objectives like entering into a new Market, acquiring a new Technology, or developing their Distribution and/or Dealers Network, etc.

New Special Purpose Vehicles allow to achieve and influence on key Strategies while protecting the core activities and the Company Balance Sheet.

It takes the convergence of MNC knowledge, Industry Know-How, Independent Advisory and Financial compliance to achieve the goals. Higher productivity demands higher sophistication in tools and strategies, and FdN is here to assist on those.

#CSF #MultinationalVentures #JointVentures #Corporate-SponsoredFunds #NewVehicles #DealerQuality #SupplierQuality #TechnologyAccess #MarketExpansions

It takes a whole life to build a decent Company. It is yours. It is not only about Money. It is about all weekends, nights, missed school appointments, and hours taken to leisure. But now it is maybe the time to think about passing the baton. Maybe some more growth still. Maybe some more value to take. In any of those cases, at FdN we have the empathy and understanding to help, we know how to express the value of what has been built, and to whom to explain it.

M&A may seem an standard, but it is not. There is only one sale of a company. There is one one buy of another one. There is no space for mistake, for regret. At FdN we always make sure Owners will always sleep well knowing that the transaction was the right one, at the right moment, to the right target. As simple (and complex) as that.

#M&A #Mergers #Acquisitions #Owners #Exits #Growth #WealthRealisation

Engineering Firms, Big Operators, Foreign Investors, Public Administrations, etc can now be sure that this Special Public-Private Tender is well structured and governed, that this Project-Financing is having the right risk treatment to get the financing, that the company is talking the language of the banks and multi-lateral financing institutions. The success of the project, its feasibility and after more importantly its profitability and performance is depending on the right structured of its financing and drivers.

At FdN we can assist with a third-party independence, with a governace between technical and financial entities, or simply by teaming-up with the company CEO's and CFO's to be sure that the Project is done on-time and properly.

Structured-Finance is a sophisticated skill, so are we.

#PPPs #Public-PrivatePartnerships #SpecialTenders #StructuredFinancing #Non-RecourseFinancing #RisksAllocations #GovernancewithParties

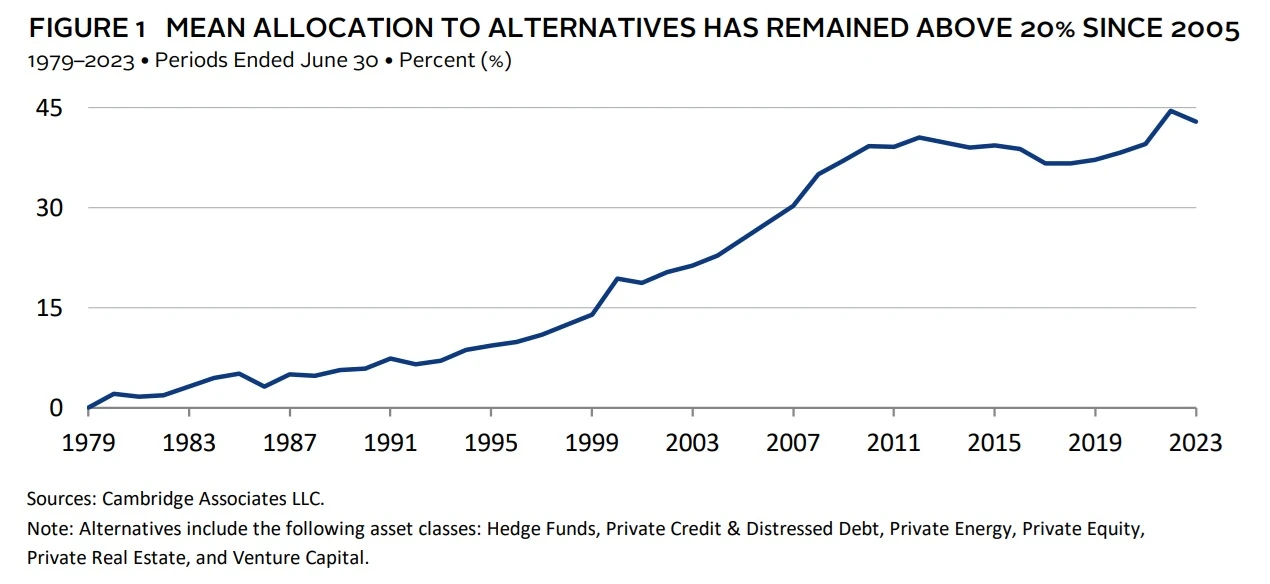

ALTERNATIVES - A "MUST-HAVE" TO BE HANDLED WITH CARE

For Institutional Portfolios, mean allocation to alternative asset classes (including Hedge Funds, Private Credit, Private Equity, Private Real Estate, and Venture Capital) has remained above 20%, with Family Offices and Family Bankers staying normally above 10% at least.

These Alternative Assets are a "must-have" to achieve the expected two-digit returns, but doing the right asset selection is by itself a big source of extra returns (alfa), much more than in Bonds or Equity markets.