We bring Investments

with committment,

purpose and alignment

Private financial markets have become a complex and risky place to transit without guidance. There are many different goals linked to the different forms of private capital, and, what is sometimes even more risky, to the attached implications to it.

At FdN we spend hours of R&D to network, to research and profiling all forms of Private Capital and Debt for the different company situations, maturities, alignment of goals, governance, track record, culture, etc. of each alternative.

We do also invest and co-invest directly ourselves in some of the opportunities.

In any situation we will make sure to be comfortable to the investors and aligned with the asset needs and the property goals. For the Asset FdN is the "phare" that is needed to navigate the Private Capital waters. For the Investors FdN is the qualified source of funnel, and in some cases, a good mission-specific partner.

HOW WE HELP

Our Vertical Approach is guiding us naturally to facilitate and support Corporate Initiatives in Multinational Companies and International Groups to help them achieve Strategic Objectives like entering into a new Market, acquiring a new Technology, or developing their Distribution and/or Dealers Network, etc.

New Special Purpose Vehicles allow to achieve and influence on key Strategies while protecting the core activities and the Company Balance Sheet.

It takes the convergence of MNC knowledge, Industry Know-How, Independent Advisory and Financial compliance to achieve the goals. Higher productivity demands higher sophistication in tools and strategies, and FdN is here to assist on those.

#CSF #MultinationalVentures #JointVentures #Corporate-SponsoredFunds #NewVehicles #DealerQuality #SupplierQuality #TechnologyAccess #MarketExpansions

It takes a whole life to build a decent Company. It is yours. It is not only about Money. It is about all weekends, nights, missed school appointments, and hours taken to leisure. But now it is maybe the time to think about passing the baton. Maybe some more growth still. Maybe some more value to take. In any of those cases, at FdN we have the empathy and understanding to help, we know how to express the value of what has been built, and to whom to explain it.

M&A may seem an standard, but it is not. There is only one sale of a company. There is one one buy of another one. There is no space for mistake, for regret. At FdN we always make sure Owners will always sleep well knowing that the transaction was the right one, at the right moment, to the right target. As simple (and complex) as that.

#M&A #Mergers #Acquisitions #Owners #Exits #Growth #WealthRealisation

Engineering Firms, Big Operators, Foreign Investors, Public Administrations, etc can now be sure that this Special Public-Private Tender is well structured and governed, that this Project-Financing is having the right risk treatment to get the financing, that the company is talking the language of the banks and multi-lateral financing institutions. The success of the project, its feasibility and after more importantly its profitability and performance is depending on the right structured of its financing and drivers.

At FdN we can assist with a third-party independence, with a governace between technical and financial entities, or simply by teaming-up with the company CEO's and CFO's to be sure that the Project is done on-time and properly.

Structured-Finance is a sophisticated skill, so are we.

#PPPs #Public-PrivatePartnerships #SpecialTenders #StructuredFinancing #Non-RecourseFinancing #RisksAllocations #GovernancewithParties

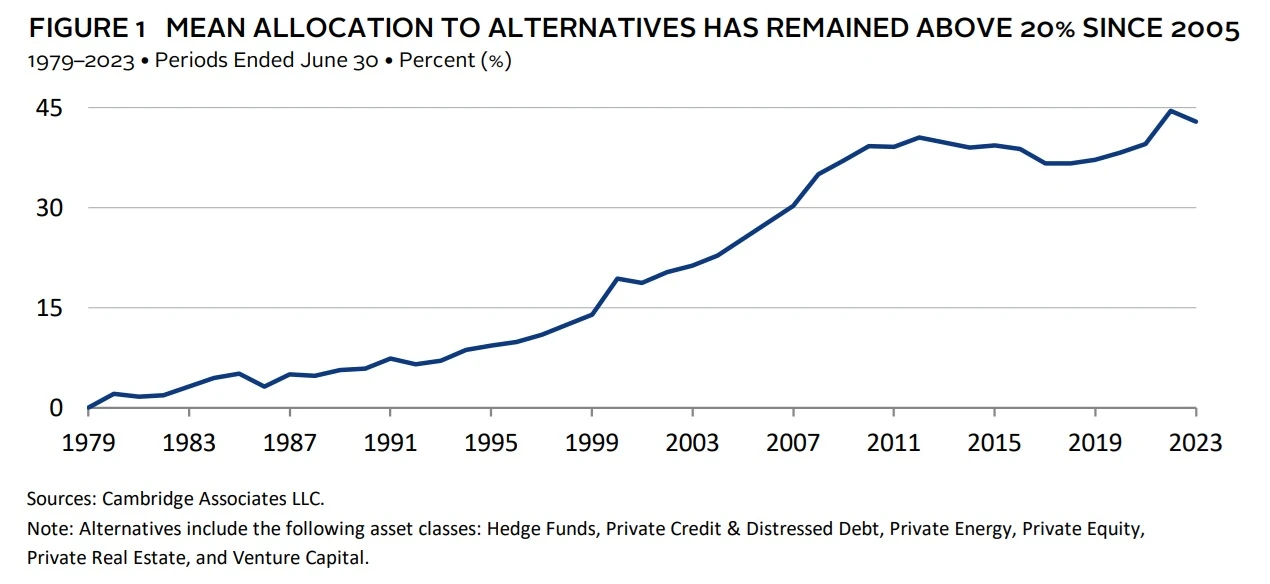

ALTERNATIVES - A "MUST-HAVE" TO BE HANDLED WITH CARE

For Institutional Portfolios, mean allocation to alternative asset classes (including Hedge Funds, Private Credit, Private Equity, Private Real Estate, and Venture Capital) has remained above 20%, with Family Offices and Family Bankers staying normally above 10% at least.

These Alternative Assets are a "must-have" to achieve the expected two-digit returns, but doing the right asset selection is by itself a big source of extra returns (alfa), much more than in Bonds or Equity markets.